How to compare car insurance quotes? With the right approach, finding the best coverage for your needs doesn’t have to be a hassle. This comprehensive guide will walk you through every step of the process, empowering you to make an informed decision that protects both your vehicle and your wallet.

Understanding the factors that impact insurance premiums, gathering quotes from different providers, and evaluating coverage options are just a few of the key steps we’ll cover. By following these expert tips, you’ll be able to compare car insurance quotes with confidence, ensuring you get the coverage you need at a price you can afford.

Factors to Consider When Comparing Car Insurance Quotes: How To Compare Car Insurance Quotes?

To ensure you’re getting the best deal on your car insurance, it’s crucial to compare multiple quotes from different insurance companies. This allows you to evaluate the coverage options, premiums, and deductibles offered by each company and choose the policy that best meets your needs and budget.

Several factors can significantly impact the cost of your car insurance premiums. These include:

Age

- Generally, younger drivers pay higher premiums due to their perceived higher risk profile.

- As you gain experience and have a clean driving record, your premiums tend to decrease.

Driving History

- Accidents, traffic violations, and other driving offenses can increase your premiums.

- Maintaining a clean driving record is essential for keeping your premiums low.

Vehicle Type

- The make, model, and safety features of your vehicle can affect your premiums.

- Vehicles with higher safety ratings and anti-theft devices often qualify for discounts.

Other Factors

- Your location, annual mileage, and credit score can also influence your premiums.

- Insurance companies use various algorithms to calculate premiums based on these and other factors.

Gathering Car Insurance Quotes

To get the best possible deal on car insurance, it’s important to compare quotes from multiple companies. This will help you find the insurer that offers the coverage you need at the most affordable price.

There are a few different ways to gather car insurance quotes. You can go online, call insurance companies directly, or work with an insurance agent. Each method has its own advantages and disadvantages.

Online Quotes

Getting quotes online is quick and easy. You can compare quotes from multiple companies in just a few minutes. However, it’s important to be aware that online quotes are not always accurate. The insurer may need to ask you additional questions or verify your information before they can give you a final quote.

Phone Quotes

Calling insurance companies directly is a good way to get more personalized quotes. The agent can ask you questions about your driving history, vehicle, and coverage needs. This can help you get a more accurate quote. However, it can also be more time-consuming than getting quotes online.

Agent Quotes

Working with an insurance agent can be a good option if you’re not sure what type of coverage you need or if you have a complex situation. The agent can help you compare quotes from multiple companies and make sure you get the best possible coverage at the best possible price.

Comparing Coverage Options

Understanding the various coverage options available in car insurance policies is crucial for making informed decisions. These options determine the extent of protection you have in case of an accident or other covered events.

The main types of coverage include liability, collision, and comprehensive. Each has its own purpose and limitations, so it’s essential to grasp their differences.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers legal expenses, medical bills, and repair costs up to the policy limits. State laws typically require a minimum amount of liability coverage.

Collision Coverage

Collision coverage protects your own vehicle in the event of a collision with another car or object. It covers repair or replacement costs, minus your deductible. Collision coverage is optional but recommended for newer or more valuable vehicles.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from events other than collisions, such as theft, vandalism, fire, and natural disasters. It also covers damage caused by animals. Comprehensive coverage is typically more expensive than collision coverage but may be worth considering for older or less valuable vehicles.

Evaluating Discounts and Additional Benefits

When comparing car insurance quotes, it’s important to consider the various discounts and additional benefits that may be available. These can help you save money on your premiums and get more value for your coverage.

Some common discounts include:

- Multi-car discount:If you insure more than one car with the same company, you may be eligible for a discount.

- Good driver discount:If you have a clean driving record, you may be eligible for a discount.

- Safety features discount:If your car has certain safety features, such as airbags or anti-lock brakes, you may be eligible for a discount.

In addition to discounts, some policies may also include additional benefits, such as:

- Roadside assistance:This coverage can provide you with assistance in the event of a breakdown, flat tire, or other emergency.

- Rental car coverage:This coverage can provide you with a rental car if your car is damaged or stolen.

When comparing car insurance quotes, be sure to ask about the discounts and additional benefits that are available. These can help you save money and get the coverage you need.

Comparing Company Reputation and Financial Stability

When choosing an insurance company, it’s essential to consider their reputation and financial stability. A reputable company with a strong financial standing is more likely to provide reliable coverage and excellent customer service.

To research company reputation, check online reviews from trusted sources like the Better Business Bureau (BBB) and Consumer Reports. You can also look for industry awards and recognition, which indicate a company’s commitment to quality.

Financial Stability

- Check the company’s financial ratings from agencies like AM Best, Moody’s, and Standard & Poor’s. These ratings assess the company’s ability to meet its financial obligations.

- Look for companies with a surplus of assets over liabilities, indicating financial strength and stability.

Negotiating and Finalizing a Policy

Negotiating for the best car insurance deal involves understanding your coverage needs, researching different providers, and comparing quotes. Before signing any policy, thoroughly review the terms and conditions to ensure it meets your requirements.

Negotiation Process

* Research and Compare Quotes:Obtain quotes from multiple insurance companies to compare coverage options and premiums.

Present Your Case

Clearly state your coverage needs, driving history, and any discounts you qualify for.

Negotiate Premiums

Discuss premium rates with the insurance agent and explore options to lower costs, such as increasing deductibles or taking defensive driving courses.

Consider Additional Coverage

Assess if additional coverage, like rental car reimbursement or roadside assistance, is necessary and negotiate their inclusion.

Policy Review and Understanding

* Read the Policy Thoroughly:Before signing, carefully read the policy to understand the coverage details, exclusions, and any limitations.

Verify Coverage

Ensure the policy aligns with your specific needs and provides adequate protection.

Clarify Unclear Terms

Ask the insurance agent to clarify any ambiguous language or clauses in the policy.

Understand Deductibles and Limits

Pay attention to the deductibles and coverage limits to avoid surprises in the event of a claim.

Ongoing Monitoring and Review

Car insurance needs can change over time, making it crucial to regularly review your policy. This ensures it continues to meet your coverage requirements and that you’re getting the best rates.

Here are some tips for monitoring changes in your coverage needs and insurance rates:

Monitor Changes in Your Coverage Needs

- Life events:Marriage, children, or moving to a new area can impact your coverage needs.

- Vehicle usage:If you’re driving less or more frequently, your insurance rates may be affected.

- Driving record:Traffic violations or accidents can lead to higher premiums.

Monitor Changes in Insurance Rates

- Shop around:Compare quotes from multiple insurance companies to ensure you’re getting the best rates.

- Ask for discounts:Insurance companies offer discounts for various factors, such as safe driving habits, loyalty, and bundling policies.

- Negotiate:Don’t hesitate to negotiate with your insurance company if you find a lower rate elsewhere.

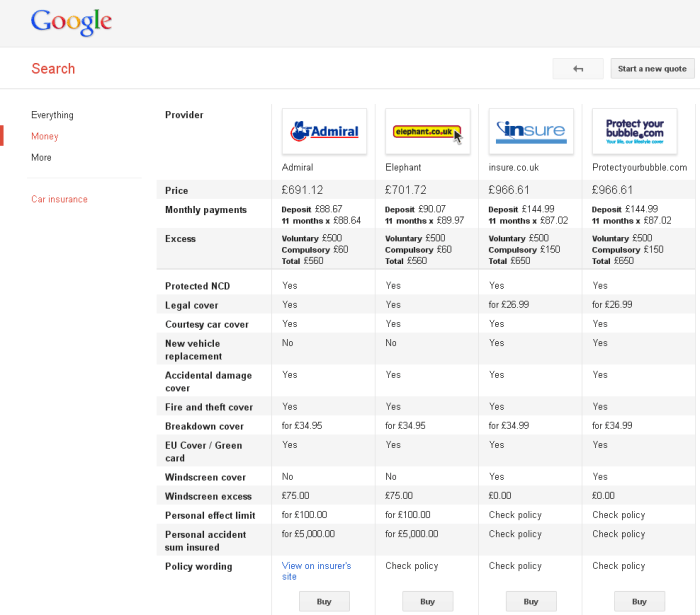

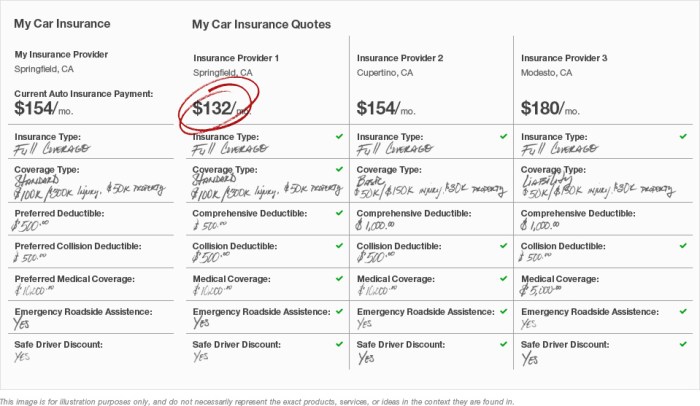

Organizing Quotes for Easy Comparison

Comparing car insurance quotes can be a tedious task, but staying organized can make it easier. Use a spreadsheet or table to track quotes from different insurance companies. Include details such as coverage levels, deductibles, and premiums. This will help you visualize the differences between quotes and make informed decisions.

Using a Spreadsheet

- Create columns for each insurance company, coverage type, deductible, and premium.

- Enter the information for each quote in the corresponding cells.

- Use formulas to calculate totals and compare quotes.

Using a Table

- Create a table with rows for each insurance company and columns for coverage type, deductible, and premium.

- Fill in the cells with the quote information.

- Sort the table by coverage type or premium to compare quotes more easily.

Avoiding Common Mistakes

When comparing car insurance quotes, it’s crucial to avoid common pitfalls that can lead to inaccurate or misleading results.

One critical mistake is failing to provide honest and accurate information to insurance companies. Misrepresenting details about your driving history, vehicle usage, or other relevant factors can result in incorrect quotes or even policy denials.

, How to compare car insurance quotes?

Another common mistake is neglecting to compare coverage options thoroughly. Different policies offer varying levels of protection, so it’s essential to understand the specific coverage you need and the costs associated with it.

Furthermore, failing to evaluate discounts and additional benefits can lead you to miss out on potential savings. Many insurance companies offer discounts for factors such as safe driving records, multiple policies, or vehicle safety features.

Final Review

Comparing car insurance quotes is not as daunting as it may seem. By following the steps Artikeld in this guide, you can confidently navigate the process, ensuring you secure the best coverage for your needs. Remember to consider factors like your driving history, vehicle type, and coverage options.

By staying organized, identifying hidden costs, and avoiding common mistakes, you’ll be well-equipped to make an informed decision. Protect your vehicle and your finances by comparing car insurance quotes today!

FAQ Resource

What are the most important factors to consider when comparing car insurance quotes?

Age, driving history, vehicle type, coverage limits, and deductibles are all key factors that impact insurance premiums.

How can I gather quotes from different insurance companies?

You can gather quotes online, over the phone, or through an insurance agent.

What types of coverage should I consider when comparing car insurance quotes?

Liability, collision, and comprehensive coverage are the main types of coverage to consider.

What are some common mistakes to avoid when comparing car insurance quotes?

Providing inaccurate information, failing to compare apples-to-apples, and neglecting to consider hidden costs are common mistakes to avoid.